The traditional banking model, once centered around physical branches, has undergone a significant transformation in recent years. With the rise of digital technologies and changing consumer expectations, banks are increasingly adopting the concept of the virtual branch. A virtual branch is a fully digital representation of a traditional bank branch, offering a wide range of financial services through online platforms. This innovation allows customers to access their banking needs from anywhere, at any time, without the need to visit a physical location.

What Is a Virtual Branch?

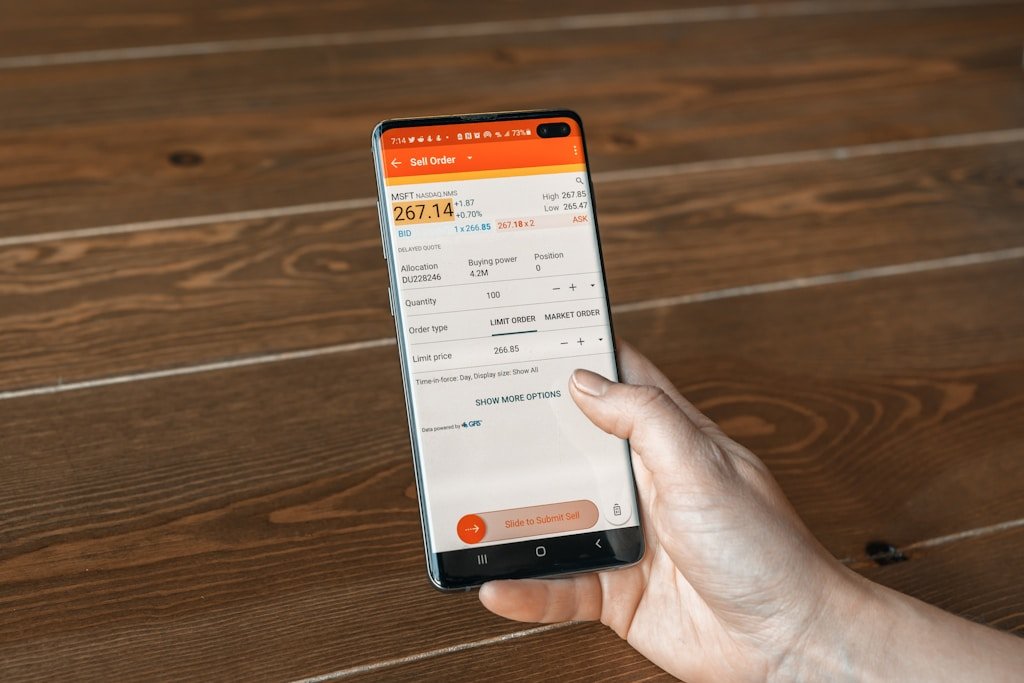

A virtual branch provides the same services that a physical branch would offer, but entirely through digital means. Customers can perform tasks such as opening accounts, applying for loans, transferring funds, and even consulting with customer service representatives through online chat or video calls. By utilizing secure digital platforms, banks ensure that their customers have access to essential services while maintaining security and compliance with financial regulations.

This shift to virtual branches is driven by the growing demand for convenience and the increasing use of digital devices. Customers no longer want to spend time traveling to a bank or waiting in line for basic transactions. Instead, they expect a seamless, fast, and efficient experience that allows them to manage their finances with just a few clicks. The virtual branch fulfills this expectation by bringing the bank directly to the customer’s home or mobile device.

Benefits of Virtual Branches for Banks and Customers

One of the main advantages of virtual branches for banks is cost reduction. Maintaining a physical branch comes with high overhead costs, including real estate, utilities, and staffing. By shifting to a virtual model, banks can significantly reduce these expenses while still providing comprehensive banking services. This allows them to allocate resources more efficiently, improving profitability while offering competitive rates and services to customers.

For customers, the convenience of a virtual branch cannot be overstated. Virtual branches are available 24/7, enabling customers to manage their finances whenever it suits them. This level of accessibility is particularly beneficial for individuals who live in remote areas or have busy schedules that make it difficult to visit a physical bank. Additionally, virtual branches often provide quicker responses to customer inquiries, with automated systems and artificial intelligence assisting in real-time.

Furthermore, virtual branches allow banks to offer more personalized services. With access to advanced data analytics, banks can better understand their customers’ preferences and financial behaviors, tailoring products and services to meet their needs. This personalization enhances customer satisfaction and builds stronger relationships between banks and their clients.

Security and Trust in Virtual Branches

As banking shifts to virtual environments, ensuring the security of customer data and transactions is paramount. Virtual branches use sophisticated encryption technologies, biometric authentication, and multi-factor verification to safeguard sensitive information. This approach reduces the risk of fraud and unauthorized access, ensuring that customers’ financial data is protected at all times.

Building trust is also crucial in the success of virtual branches. Banks must ensure that their digital platforms are user-friendly and transparent, allowing customers to feel confident when conducting transactions online. Offering virtual consultations with live representatives can further bridge the gap between digital convenience and the personalized service traditionally found in physical branches.

The Future of Virtual Branches

As technology continues to evolve, the role of virtual branches will become even more integral to the banking industry. Artificial intelligence, machine learning, and blockchain technologies will further enhance the capabilities of virtual branches, making financial services more secure, efficient, and customer-centric. Moreover, as customers increasingly prioritize convenience and digital experiences, banks that invest in virtual branches will be well-positioned to thrive in the future.

In conclusion, the virtual branch represents the next stage in the evolution of banking. By offering the same services as physical branches but with greater convenience, accessibility, and efficiency, virtual branches cater to the needs of modern customers while providing banks with a cost-effective and scalable solution. As the banking landscape continues to shift toward digital platforms, virtual branches are poised to become the new norm in the financial services industry.